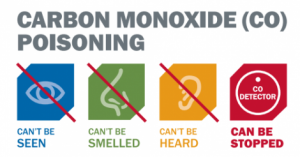

Have you owned your home since before 2011? If so, do you know if you have a carbon monoxide detector installed in your home? Since the California Carbon Monoxide Poisoning Prevention Act of 2010 was passed in early 2011, it is now a requirement by law, and a retrofit requirement when selling your home that CO monitor be present.

How do you know if you are exposed to carbon monoxide?

How do you know if you are exposed to carbon monoxide?

Carbon monoxide is virtually undetectable by humans. It is colorless, odorless, and tasteless. Accidental over-exposure to carbon monoxide results nearly 200 deaths every year. It is emitted by various equipment in and around your house such as:

- Fuel fired furnaces and fireplaces

- Gas water heaters

- Gas stoves

- Gas dryers

- Charcoal grills

- Lawnmowers and other yard equipment

- Automobiles

1. The best defenses against carbon monoxide poisoning is installation of a CO detector.

2. Proper installation, use, and maintenance of household cooking and heating equipment, and safe use of vehicles and other gas-powered equipment.

How should I install my CO Detectors?

1. Centrally located outside of each sleeping area in the immediate vicinity of the bedrooms

2. At least 6 inches from all exterior walls , and at least 3 feet from supply or return vents

3. Avoid locations that can be covered by furniture or draperies.

How do you test the CO Detector to ensure it is working?

How do you test the CO Detector to ensure it is working?

Consumers should follow the manufacturer’s instructions. Using a test button tests whether the circuitry is operating correctly, not the accuracy of the sensor.

What should you do if the CO alarm sounds?

1. Never ignore an alarming CO alarm!

2. Immediately move outside to fresh air.

3. Call your emergency services, fire department, or 911.

4. Do a head count to check that all persons are accounted for. DO NOT reenter the premises until the emergency services responders have given you permission.

Are CO Detectors reliable?

CO alarms always have been and still are designed to alarm before potentially life-threatening levels of CO are reached. The safety standards for CO alarms have been continually improved and currently marketed CO alarms are not as susceptible to nuisance alarms as earlier models.

Even if you aren’t planning to sell your home, it is best to air on the side of caution and have CO detectors installed as soon as possible. These inexpensive devices (costing around $100) can potentially save a life. If you are unsure about the maintenance of gas-powered appliances in your home, consider having a qualified technician inspect your appliances to ensure their safety, and discuss proper installation of detectors. This small measure can prevent you and your family from falling victim to carbon monoxide poisoning.

Even if you aren’t planning to sell your home, it is best to air on the side of caution and have CO detectors installed as soon as possible. These inexpensive devices (costing around $100) can potentially save a life. If you are unsure about the maintenance of gas-powered appliances in your home, consider having a qualified technician inspect your appliances to ensure their safety, and discuss proper installation of detectors. This small measure can prevent you and your family from falling victim to carbon monoxide poisoning.

You’ve probably heard the misconception that the Holiday season is not a good time to list your home for sale. The truth is, the winter months are the perfect opportunity for you to have success with selling your home. Below is a list of reasons explaining why the holidays are a great time to put your home on the market:

You’ve probably heard the misconception that the Holiday season is not a good time to list your home for sale. The truth is, the winter months are the perfect opportunity for you to have success with selling your home. Below is a list of reasons explaining why the holidays are a great time to put your home on the market:

er assets in a living Trust.

er assets in a living Trust.