Are you thinking of selling your home? The thought can be overwhelming if you don’t have the guidance of an experienced team on your side. The Mendelsohn Group has over 12 years of property sales and listing experience. We specialize in the following to ensure a stress-free transaction, and get the best possible outcome for our clients:

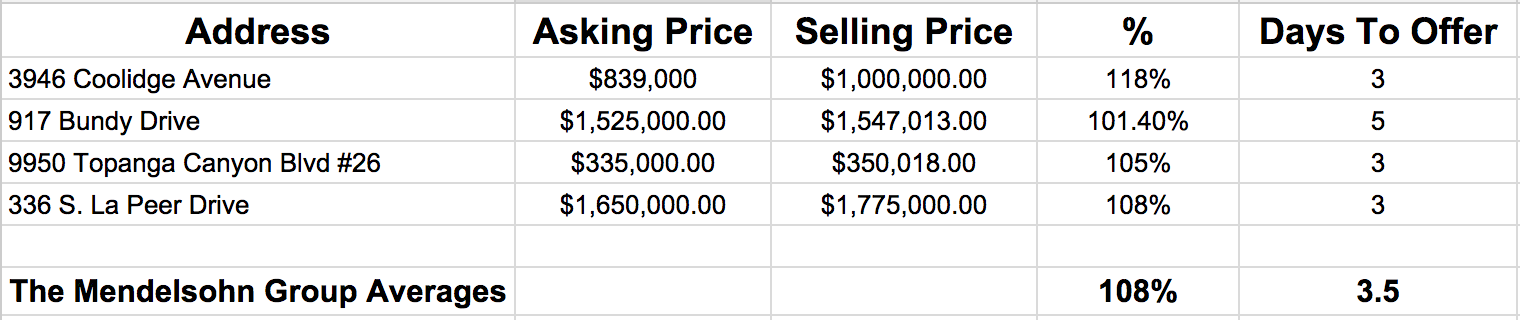

- An average of 108% of percent of asking price

- Full preparation of the home, and assistance with all renovations ranging from painting to complete kitchen refacing. Click here to see our unique approach.

- Complete consultation on property condition to determine which repairs are most cost effective prior to listing, preventing and reducing buyer credit requests while in escrow.

- Access to and referrals of top notch service providers for any repairs

- Marketing the listing on multiple platforms, to ensure it is reaching the biggest audience

- Under 4 days* on market to receive first offer (*average based on 4 most recent sales) Click here to see the outcome of all of our most recent sales.

- Bathroom Before

- Bathroom After

- Kid’s Bedroom Before

- Kid’s Bedroom After

- Living Room Before

- Living Room After

- Living Room Before

- Living Room After

The Mendelsohn Group strives to get the most for our clients, through our unique approach in preparation for launch, to our negotiation skills during the escrow process, all the way to staying in touch long after the close of the sale. Take it from our clients below, who sold their home for 18% OVER asking price working with The Mendelsohn Group, and click here to read more of what people have to say about us!

She was patient, professional, and extremely knowledgable…

She was patient, professional, and extremely knowledgable…

“We recently sold our Mar Vista home and realtor Revi Mendelsohn worked with us from day one to put together a successful sale. She worked closely with us months before our home sale to determine what sort of improvements we might decide to make. She helped guide us through so many complicated decisions about the best ways to prepare our house to go on the market. Every step of the way, she was patient, professional, and extremely knowledgable. In fact, every piece of her advice paid off. We sold our house for way over our asking price and I’m certain the amazing result we achieved was due to her smart, sensitive, and forward-thinking approach. I had seen her recommended so many times online and wondered if she was really as good as everyone said. And I can tell you that she absolutely is the real deal. She is so easy to work with and will go to bat for you no matter what. You will not be disappointed. If you or anyone you know needs some real estate assistance, talk to Revi. You’ll be so happy you did!” – Cindy and Trent Jones, Home Sellers in Mar Vista 2015

If you have any questions or inquiries, feel free to call Revi at 310-963-7384. We look forward to hearing from you soon!

You’ve probably heard the misconception that the Holiday season is not a good time to list your home for sale. The truth is, the winter months are the perfect opportunity for you to have success with selling your home. Below is a list of reasons explaining why the holidays are a great time to put your home on the market:

You’ve probably heard the misconception that the Holiday season is not a good time to list your home for sale. The truth is, the winter months are the perfect opportunity for you to have success with selling your home. Below is a list of reasons explaining why the holidays are a great time to put your home on the market:

er assets in a living Trust.

er assets in a living Trust.