Halloween is always fun for the whole family, and the city of Los Angeles surely knows how to get in the spooky spirit! It’s become tradition in some neighbourhoods to decorate the entire block, or go all out for one massive haunted house. In a city known for its theatrics, it’s hard to choose the coolest spots to do your trick-or-treating this year. That’s why we’ve chosen the top 5 best spots on the Westside of LA for the family to experience spectacle, scares, and of course…CANDY!

Halloween is always fun for the whole family, and the city of Los Angeles surely knows how to get in the spooky spirit! It’s become tradition in some neighbourhoods to decorate the entire block, or go all out for one massive haunted house. In a city known for its theatrics, it’s hard to choose the coolest spots to do your trick-or-treating this year. That’s why we’ve chosen the top 5 best spots on the Westside of LA for the family to experience spectacle, scares, and of course…CANDY!

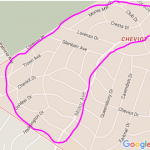

1.Cheviot Hills

Almost all of Beverlywood and Rancho Park flock to Cheviot Hills to get the their thrills and treats every year. On Motor Avenue in particular, one house goes all out with decorations, music, strobe lights, and loads of kid friendly scares.

2. Beverly Hills (Walden Drive)

There is no greater treat than visiting the famous Spadena House (more popularly k

nown as the “Beverly Hills Witch House”)on all Hallow’s Eve! The entire street seems to feed off the energy of the house, as everyone decorates and celebrates by giving out loads of candy. This is quite a popular spot on the big night, so be sure to get there early to beat the crowds.

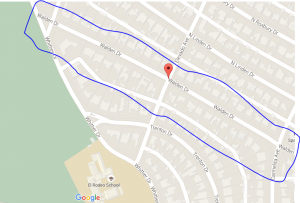

3. Venice Canals

If you are worried about the dangers of traffic on Halloween (who isn’t?) than this is the perfect place for you! The four block area is magically spooky with pumpkins and twinkle lights strung along the canals, fantastic decorations, and plenty of the requisite sugar treats. Parking can be a hassle, but as long as you plan ahead it is worth a little parking search.

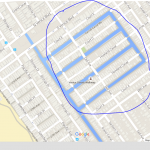

4. Santa Monica (25th Street)

Perhaps the most decorative of the bunch, the scene on 25th Street between Montana Avenue and San Vicente Boulevard will blow you away. This block has really taken to adorning their houses and yards with giant spiders, makeshift graveyards, and inflatable pumpkins!

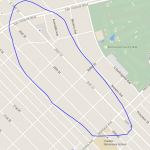

5. Brentwood Glen

Just west of the bustling 405 freeway is the small pocket of Brentwood Glen – a surprisingly quite neighborhood full of young families. This is the perfect spot for your first time trick-or-treaters and all the little ones on the search for candy. The homes are very close to one another, and very few cars pass in the evening. Although it is quite, the neighbours still decorate with fun and kid friendly haunted houses.

Remember, always exercise caution when approaching a home, and be especially cautious when crossing the street. Stay safe and HAPPY HALLOWEEN from The Mendelsohn Group!