With the prices of homes in metropolitan areas still below their highest values and mortgage rates still teetering on historic lows, the monthly mortgage payment on a median priced home is less than at almost any time in the last 25 years.

With the prices of homes in metropolitan areas still below their highest values and mortgage rates still teetering on historic lows, the monthly mortgage payment on a median priced home is less than at almost any time in the last 25 years.

In a recent report from Trulia, it is explained that owning a home remains cheaper than renting with a traditional 30-year fixed rate mortgage throughout the 100 largest metro areas in the U.S. Nationally, the price of owning is an average of 35% less expensive than renting. In the Los Angeles area, that rate is between 20-40%!

How is this possible you ask? Let’s take a look at the numbers:

- Interest rates have remained low and even though home prices have appreciated around the country (3.9%), they haven’t greatly outpaced rental appreciation (3.7%). In the past year, these two trends have made homeownership even more affordable compared with renting.

- Some markets might tip in favor of renting next year if home prices increase at a greater rate than rents and if mortgage rates rise, due to the strengthening economy. However…

- Nationally, rates would have to rise to 10.6% for renting to be cheaper than buying – and rates haven’t been that high since 1989!

- The National Association of Realtors performed a study in which they looked at income growth, housing costs and changes in the share of renter and owner-occupied households over the past five years. They found that a typical rent rose 15% while the income of renters grew by only 11%.

- The average renter in the United States pays 30% of their income on housing compared to that of a homeowner who can expect to spend 15%.

The bottom line is that buying a home makes sense. Rental costs have historically increased at a higher rate of inflation. Now is the time to lock in a low interest rate and work towards your goal! Consider the following if you are on the fence about taking the leap into homeownership:

The bottom line is that buying a home makes sense. Rental costs have historically increased at a higher rate of inflation. Now is the time to lock in a low interest rate and work towards your goal! Consider the following if you are on the fence about taking the leap into homeownership:

- There are many benefits to homeownership. One of the top ones is being able to protect yourself from rising rents and lock in your housing cost for the life of your mortgage.

- Homebuyers who purchased their home over the same five-year period locked in their housing costs and were able to grow their net worth as home values have increased and their mortgage balances have gone down.

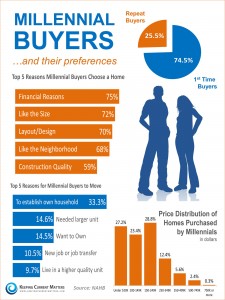

- According to a poll by DigitalRisk.com, over 60% of first time homebuyers who recently bought a home put down less than 20%, while 36% put down less than 5%.

- Speak with a realtor you can trust – they can help you plan your journey to buying a home, and making it as stress-free as possible!